Stash retirement calculator

403b How to Rollover a 401K Roth IRA. Stash Invest Review 2022.

Stash Invest Review Should You Trust This Investing App

This online calculator finds your full normal retirement age based on your birth year then calculates your retirement date by adding retirement age to your birthday.

. See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. An RRSP is an excellent place to stash those retirement savings if you anticipate being in a lower tax bracket than when you were contributing. If youd like to know how to estimate compound interest see the article on.

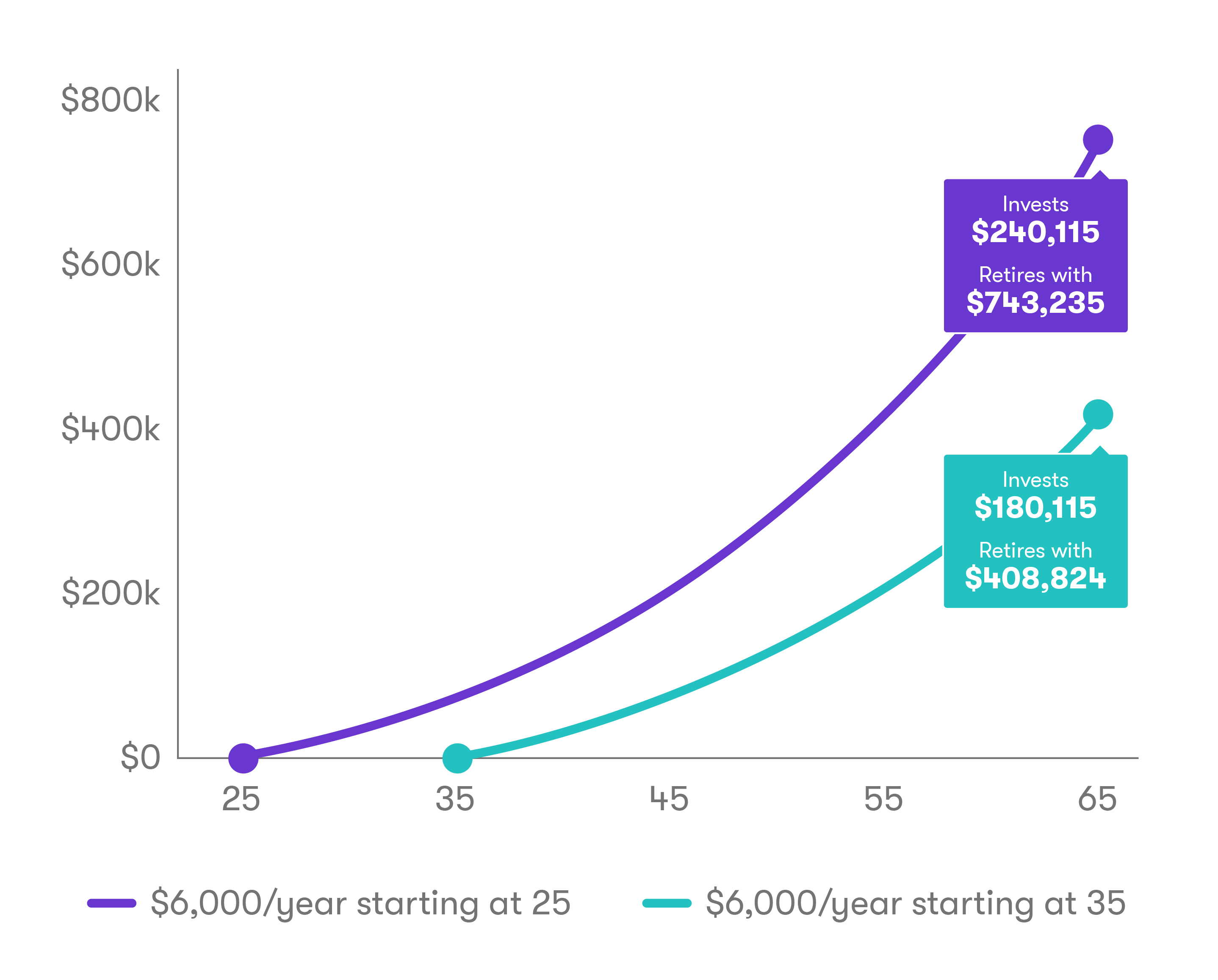

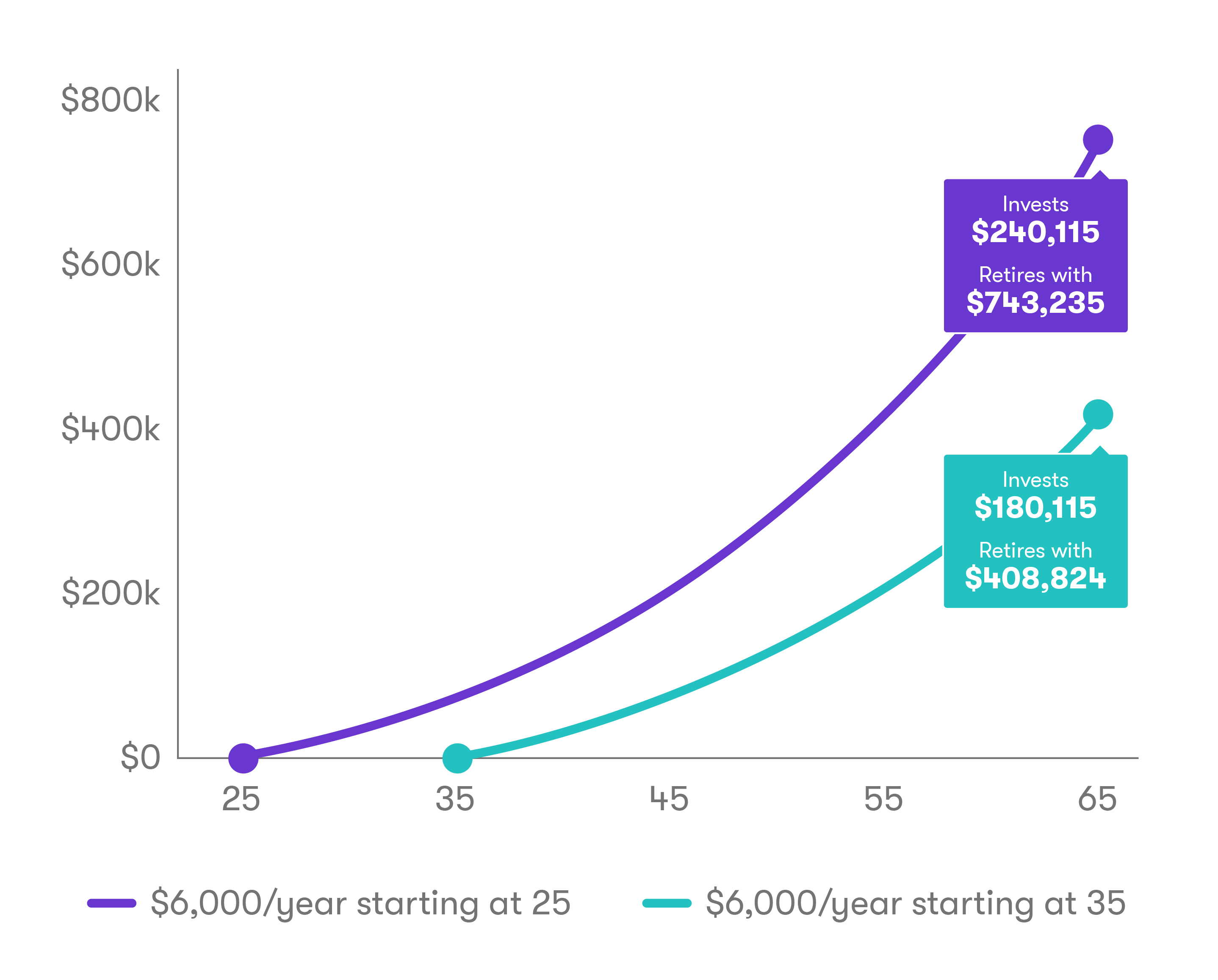

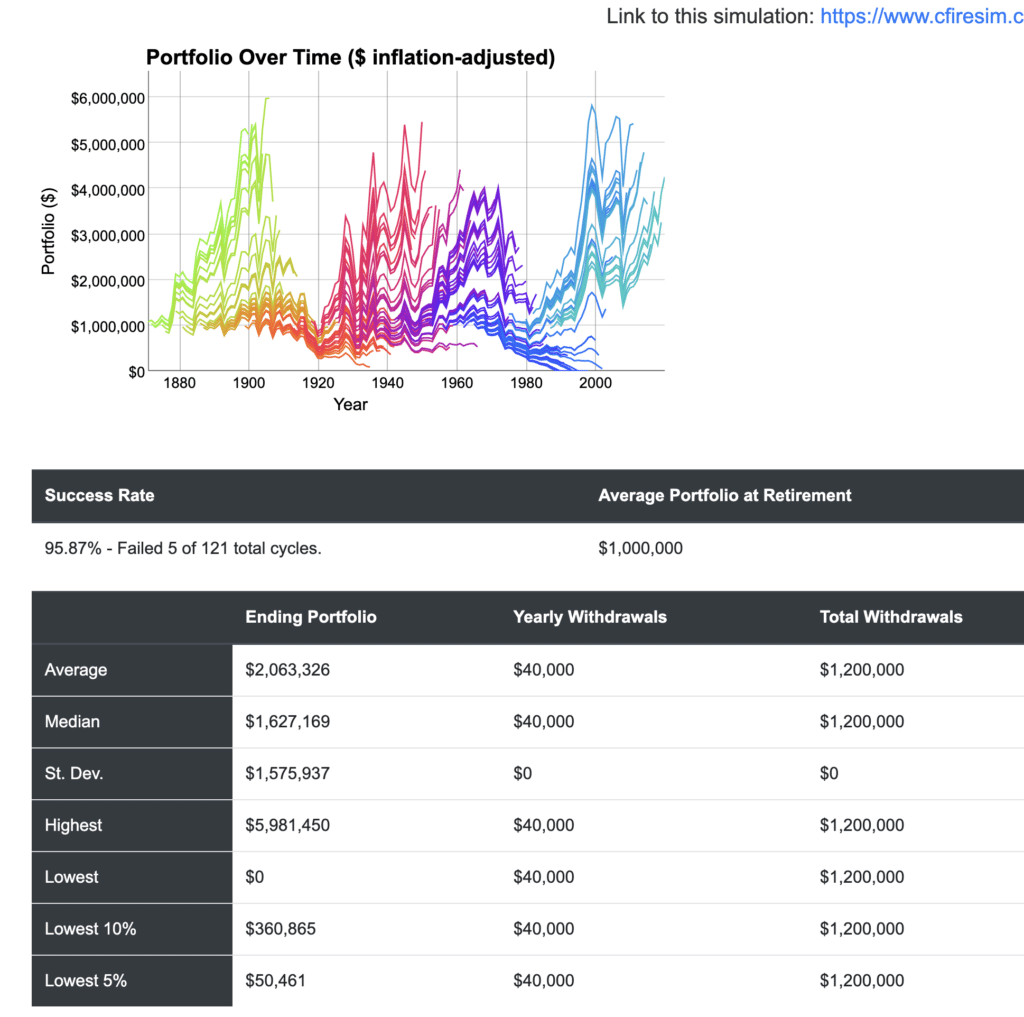

But we know life isnt perfect and sometimes a late start is unavoidable And very common. This 4 withdrawal rate was found by the Trinity Study to have a 100 success rate over a 30-year retirement horizon with a 50 50 mix of stocks and bonds. Liberty financial advisers are there to provide you with comprehensive financial planning guidance and services.

Should You Pay Off Your Mortgage or Invest. What Is a 401k. However investments of 100000 or more may be subject to different term lengths and interest rates than those provided in this calculator.

Fill in a form and an adviser will get back to you. Retirement age is defined as of Feb 2020 based on the Full Retirement Age page on Social Security Administration site. Shed like to be able to fully retire by 65.

We offer interest rates ranging from 1199 - 5999 APR Annual Percentage Rate however rates may vary case to case. An ANZ Advance Notice Term Deposit has a 31 day notice period for early withdrawal. Save for Retirement Invest Invest for Income Invest Offshore Invest for Education STASH.

Most people choose a monthly payout also known as a life annuity Having that steady income can make for less. This calculator has been set to a maximum deposit of 4999999. Our loans range from 1000 to 500000 with repayment periods starting from 3 months to 36 months.

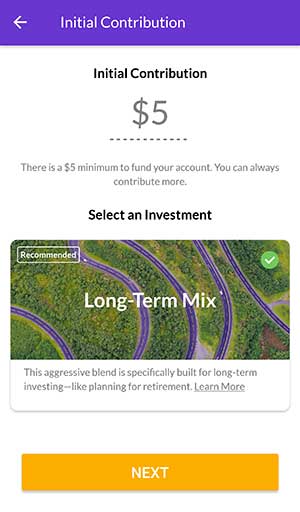

Stash does not monitor whether a customer is eligible for a particular type of IRA or a tax deduction or if a reduced contribution limit applies to a customer. This is a Non-Discretionary Managed Account. This information should not be relied upon as research investment advice or Tax advice.

With the market as it is Im putting off that purchase for six to nine months. Investing Involves risk including possible loss of principal. This means that her time horizon until retirement is 28 years.

The Liberty investment calculator lets you calculate the investment amount needed investment term and the future value of your investment. Sorry to do this to you but the best answer is. Finance experts recommend saving at least 3 months of living expenses.

Stash does not verify the completeness or accuracy of such information. This is an easy simple retirement calculator in Google Sheets to help you see what your financial situation might look like based on several customizable factors like desired yearly spending. Im holding 300000 in cash that I plan to put into a new home.

Retirement Portfolio is an IRA Roth or Traditional. Use a private browsing window to sign in. A minimum deposit of 5000 is required to open the product.

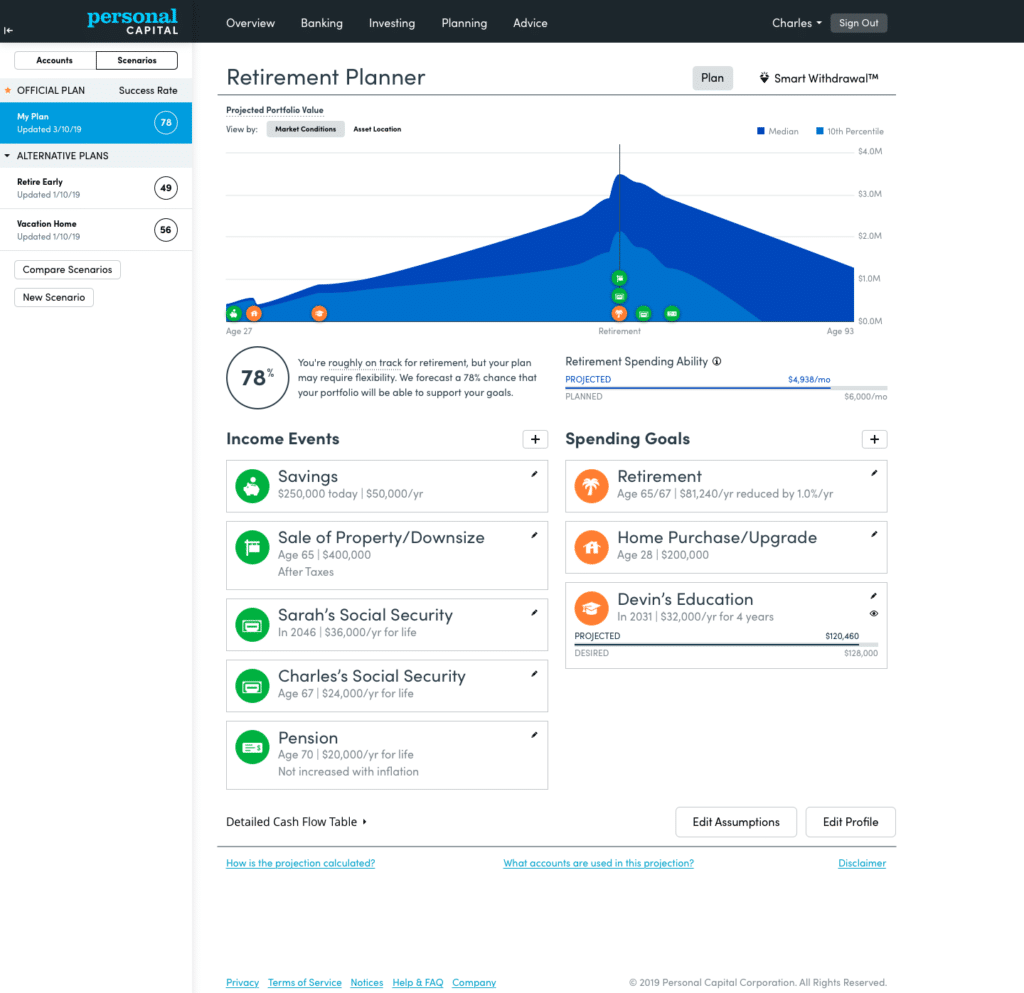

An emergency savings account is a stash of money set aside to cover any financial surprises life may throw your way. Personal Capital Review 2022. This section is all about planning for your financial future from emergency savings to retirement contributions.

Im 66 years old single and plan to retire. Helping make finance easy. Time horizon Your desired traditional retirement age Your Current age.

There can be no assurance that the results of this retirement calculator will be successful. And theres no guarantee any stock will pay dividends in a quarter or year. This interactive calculator makes it easy to calculate and visualize the growth of your net worth on your journey to Fat FIRE.

Investor Junkie is your shortcut to financial freedom. Contributions are tax-deductible which means you can reduce the tax you pay now avoiding tax on RRSP money until retirement is beneficial as many people will pay a lower rate of tax in retirement. You can calculate the time horizon until retirement simply by subtracting your current age from the age at which youd like to retire.

A 2018 Federal Reserve report revealed that 25 percent of. Personal Capitals Retirement Planner. Retirement Stash Builder Spreadsheet.

En español In a perfect world we would all begin saving for retirement from the time we receive our first paycheck says Nicole Gopoian Wirick a certified financial planner CFP in Birmingham Michigan.

Stash Review Pros Cons And Who Should Open An Account

Best Retirement Planning Tools For 2022 Some Are Even Free

Try Our Compound Interest Calculator Stash

Who Wants To Retire A Millionaire

Best Retirement Planning Tools For 2022 Some Are Even Free

Stash Review Is Stash Investment Legit Does Stash Investing Work Homer News

Year In Review Some Of The Biggest Stories Of 2020 Stash Learn

5 Best Retirement Planners And Apps 1 Is Free Robberger Com

What Are Tax Consequences Of Selling From A Retirement Account Stash Learn

Stash Retire How To Open An Ira With Stash Student Debt Warriors

How Does Stash Make Money Fourweekmba

5 Tips For Young Investors Stash Learn

Stash Retire How To Open An Ira With Stash Student Debt Warriors

Stash Review Pros Cons And Who Should Open An Account

Retirement Goals How Stash Can Help You Reach Them Stash Learn

Stash Retire How To Open An Ira With Stash Student Debt Warriors

5 Best Retirement Planners And Apps 1 Is Free Robberger Com